- GTG Weekly

- Posts

- 💸 This Week Could Move Rates

💸 This Week Could Move Rates

Mortgage Rates Tick Up ⬆️. Fed decision tomorrow, Jobs Friday, Sluggish Sales in June, Camping Prep, High Balance Loan vs Jumbo.

Issue 125 - Hello and Happy Tuesday.

The Fed meets this Wednesday, and no one expects them to touch rates. It’s likely another “hold steady” moment, but don’t let that lull you into thinking this week will be quiet.

Gif by cbs on Giphy

We all know that the rates the Fed controls (Fed Funds Rate) are not mortgage rates, but a movement by the Fed could still trigger bond market movement that would affect mortgage rates.

The real action could come Friday with the jobs report. If the labor market shows any surprises, good or bad, it could spark a noticeable move in mortgage rates. This is the kind of week where timing matters.

Personal Note:

There will be no newsletter next week. We are going camping to cap off the Summer. Headed out to Casini Ranch on the Russian River. This week marked the start of the “Is all our camping stuff sorted?” gear checks, lol. Of course it’s not.

We’re also going to the Sonoma County Fair on Friday. Last year was a bit of a letdown, and it felt very big-boxed in the previous few years. Now that the horse races are gone, we’re willing to give it one more try. Here’s to $8 dry churros and $16 beers!

Great rundown by my buddy Robby below on the fair this year.

Pictures and adventures next go around!

TLDR (Too Long Didn’t Read) Summary

⬆️ RATES - Trend upward slightly ahead of Fed and Jobs this week.

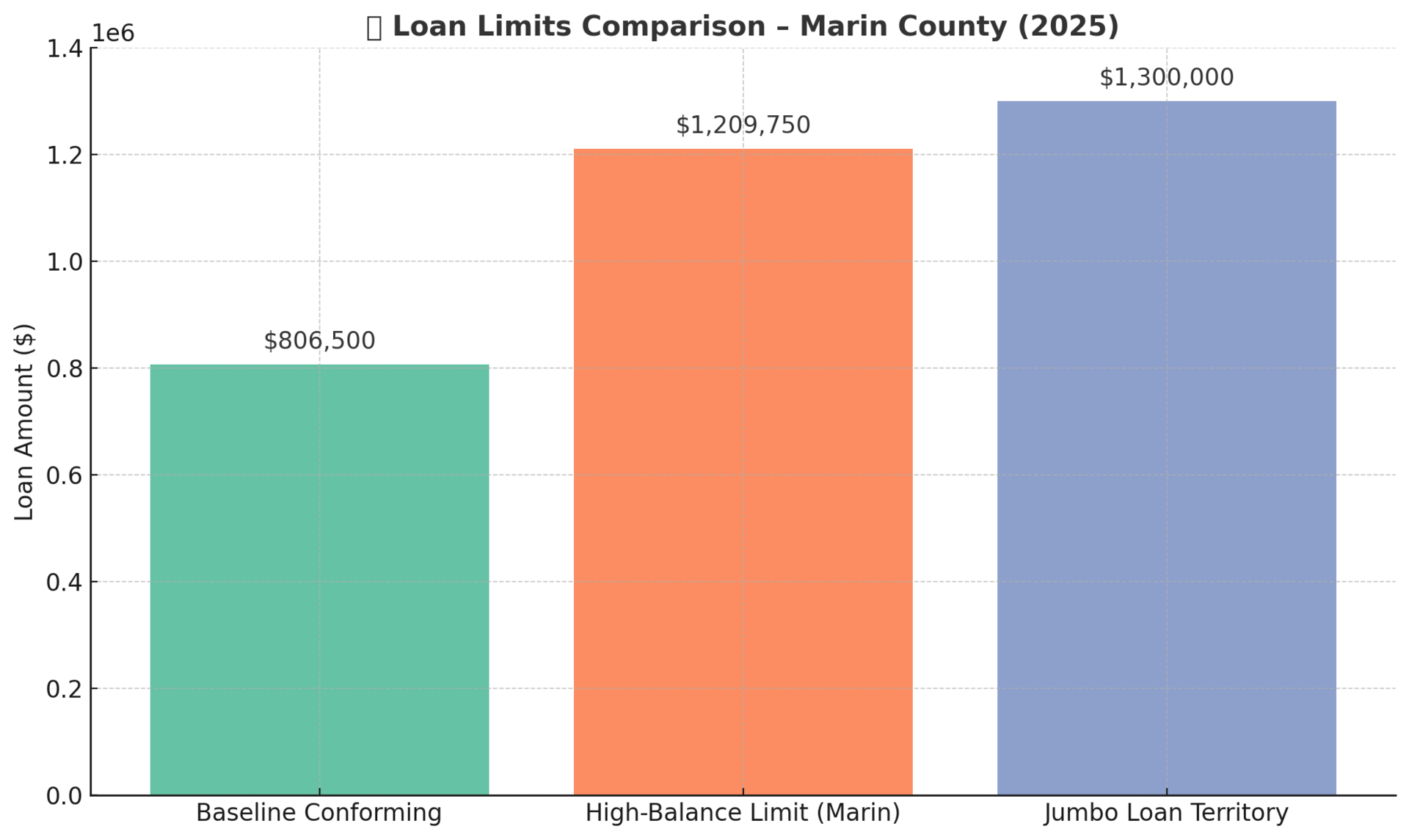

📈 TECHNICALS - High balance vs Jumbo loan size.

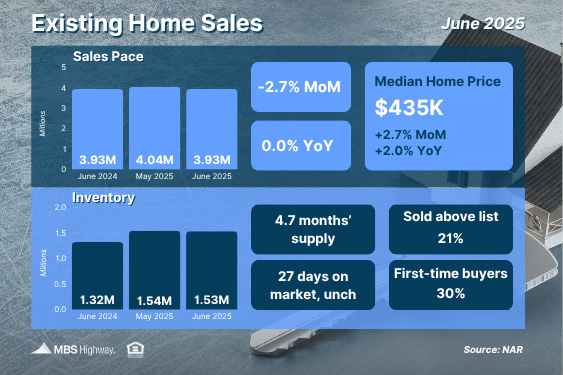

📊 TECHNICALS - Existing home sales slump.

INTEREST RATES

Rates 📢 July 29th, 2025

10 year 3 - Month Snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

⬆️ Conv. | 6.750% / 6.774% | +.125% |

⬆️ Conv. HB | 6.999% / 7.009% | +.125% |

↔️ JUMBO | 6.500% / 6.528% | -.000% |

⬆️ FHA 3.5% DP | 6.125% / 7.067% | +.125% |

↔️ VA 0% DP | 6.125% / 6.371% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

📈 Rates Edge Up Ahead of Critical Fed & Jobs Week

Mortgage rates moved up slightly this week after several weeks of improvement. The bump is tied to bond market hesitation ahead of two big catalysts: the Fed meeting on Wednesday and the all-important Jobs Report on Friday. While the Fed is not expected to cut rates, their tone on inflation and growth could move markets. A hawkish stance = more upward pressure on rates.

🌐 Tariff Talk Cools… But Inflation Worries Linger

The U.S.-EU trade deal lowered some tensions (and car tariffs), but the inflation impact from new import costs hasn’t fully hit yet. That looming price pressure is still a wildcard, especially with the Fed’s preferred inflation metric (PCE) also releasing this week. If inflation runs hotter than expected, rate improvement could stall—or reverse.

📊 Jobs Data Could Be a Game Changer

This Friday’s Jobs Report could be the most impactful data point of the month. Forecasts suggest slowing job growth and a slight rise in unemployment, but any surprise to the upside could send rates higher quickly. On the flip side, signs of weakness in the labor market could give mortgage rates more breathing room.

🔑 Realtor Insight

Rates are still lower than they were in June, but this recent uptick is a reminder that the market is on edge. Use this moment to check in with fence-sitters and pre-approved buyers—especially those who need to lock in before Friday’s data or before the Fed hints at keeping rates higher for longer.

TECHNICALS

Home Sales Sluggish in June

📉 Existing Home Sales Hit 9-Month Low

Closings on existing homes dropped 2.7% in June — worse than expected — falling to an annual pace of 3.93 million. That's the lowest level since last September.

💰 The median price hit a record $435,300, but this doesn’t mean homes are getting more expensive — it's just the midpoint of all homes sold. Tight supply (only 1.08M active listings) and years of underbuilding continue to prop up prices.

🧠 Realtor Insight: Buyers waiting for a price drop may be disappointed. Tight inventory is keeping values high, even as transaction volume dips.

🧾 Unemployment Claims Reveal a Stubborn Job Market

New jobless claims dropped again to 217,000 — a good sign — but continuing claims rose to 1.955 million, signaling that once folks lose their jobs, it’s taking a while to find new ones.

🧠 Realtor Insight: A slow hiring market may temper some buyer confidence, especially for first-time or dual-income households. Pre-approvals should reflect realistic income scenarios.

🔍 What to Watch This Week

Big week ahead with lots of potential market movers:

📊 Tuesday: Home price appreciation & job openings

📝 Wednesday: Pending home sales, GDP report, Fed rate decision

🔥 Thursday: PCE inflation index (Fed’s favorite)

👷♂️ Friday: Non-farm payrolls & unemployment rate

All of this could impact mortgage rates — especially the Fed meeting and jobs data. Stay tuned.

🧠 Realtor Insight: With economic data hitting every day, your pre-approval clients may see rate swings. Stay in touch and let us know if someone is getting close to writing an offer — rate locks could be smart mid-week.

Reply