- GTG Weekly

- Posts

- What is High Balance?

What is High Balance?

What Every Agent and Borrower Should Know About High-Balance vs Jumbo Loans

TECHNICALS

Understanding Loan Limits (2025)

🏡 Big Loan ≠ Jumbo

Understanding High-Balance Conforming Loans in California (2025 Edition)

When you're working with buyers in high-cost parts of California, loan limits can get confusing fast. Just because a loan is large doesn’t automatically make it a jumbo. In fact, many buyers can still stay within conventional guidelines—and that means better terms, easier approvals, and lower down payment options.

We’re not talking about purchase price, but the loan limit - aka how big of a loan is the borrower getting.

Here’s what you need to know to guide your clients confidently through the 2025 landscape.

📝 TL;DR for 2025

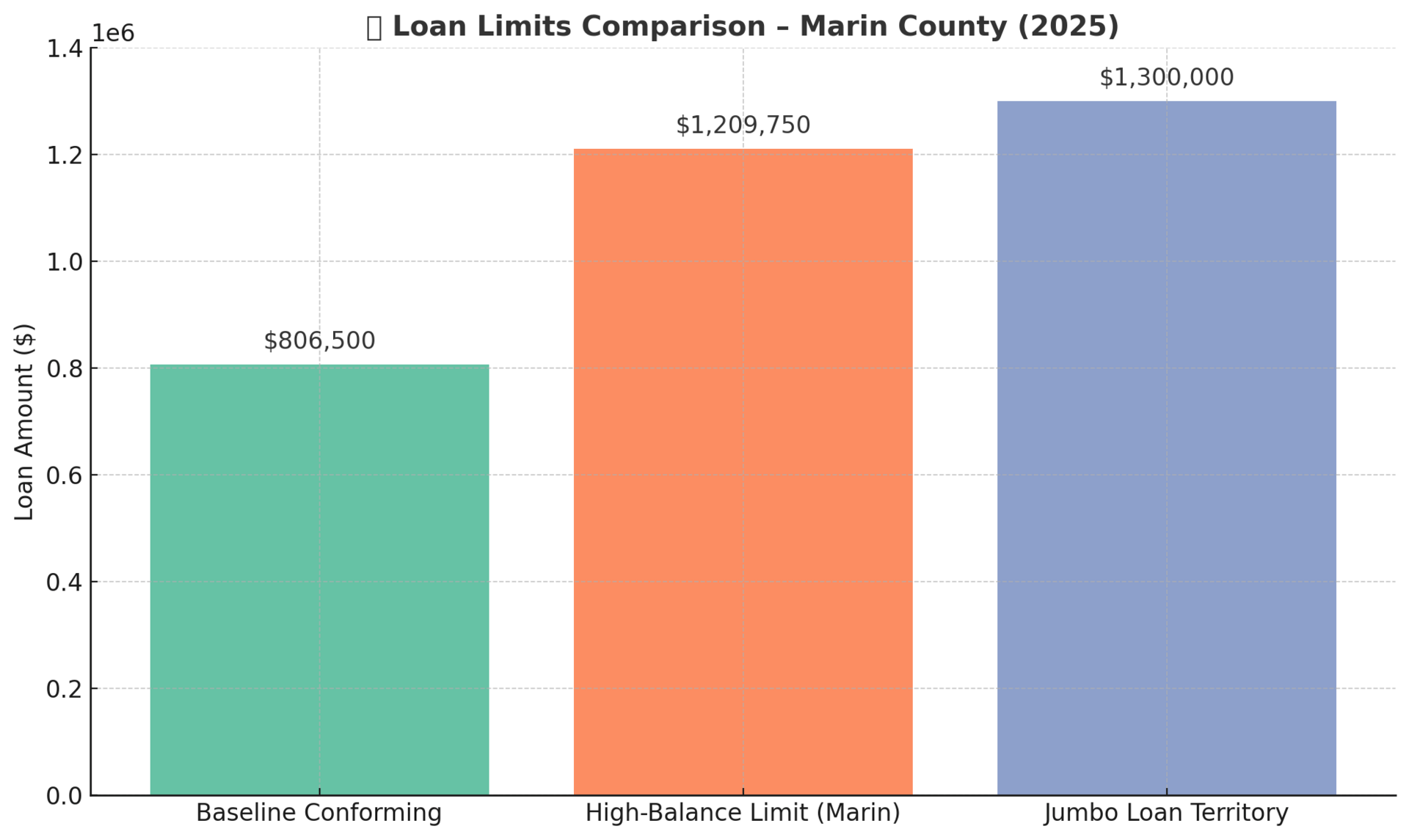

Baseline conforming limit: $806,500 (conventional only)

High-balance ceiling: $1,209,750 in select CA counties

Loan amounts above the county’s high-balance limit = jumbo

High-balance loans allow as little as 5% down

Jumbo loans usually need 10–20% down and come with stricter rules

💸 2025 Conventional Loan Limit Basics

Let’s start with the foundation:

Baseline conforming limit (nationwide): $806,500 for a 1-unit property

In designated high-cost areas, the conforming limit (called high-balance) can go up to $1,209,750

These limits apply to conventional loans only—Fannie Mae and Freddie Mac financing. FHA, VA, and USDA loans have their own guidelines and limits.

If your buyer stays under their county’s high-balance limit, they’re still working with a conforming loan—not jumbo.

📍 California County Loan Limits – Conventional Only (2025)

Below is a quick-reference table of key California counties, showing what’s possible for 1-unit homes with a conventional loan:

County | Baseline Conforming | High-Balance Limit |

|---|---|---|

Alameda | $806,500 | $1,209,750 |

Contra Costa | $806,500 | $1,209,750 |

Los Angeles | $806,500 | $1,209,750 |

Marin | $806,500 | $1,209,750 |

Orange | $806,500 | $1,209,750 |

San Diego | $806,500 | $1,077,550 |

San Francisco | $806,500 | $1,209,750 |

San Luis Obispo | $806,500 | $967,150 |

San Mateo | $806,500 | $1,209,750 |

Santa Barbara | $806,500 | $913,100 |

Santa Clara | $806,500 | $1,209,750 |

Santa Cruz | $806,500 | $1,178,750 |

Sonoma | $806,500 | $897,000 |

Ventura | $806,500 | $1,017,750 |

📌 Note: These limits apply to conventional loans only.

✅ High-Balance Conforming Loans (Still Conventional)

Don’t let the term “high-balance” confuse your buyers. These are still conforming loans—they’re just allowed to go higher in certain counties due to elevated home prices.

Fannie Mae/Freddie Mac eligible

Same guidelines as regular conforming: credit, income, assets, DTI, reserves

Only 5% down needed (sometimes 3% for first-time buyers under baseline limit)

Mortgage insurance is available when the loan exceeds 80% LTV

Slightly higher interest rates compared to baseline conforming—but far lower than jumbo

🚫 Jumbo Loans (Non-Conforming)

Once a loan exceeds the high-balance limit for the county, it becomes jumbo—and that changes everything.

Not backed by Fannie Mae or Freddie Mac

10% down is typically the minimum, but 20%+ down is often required for competitive pricing

No mortgage insurance means low-down jumbo loans come with very high interest rates

Lenders may impose overlays: higher credit score minimums, stricter DTI caps, additional reserves

Slower and more manual underwriting process, especially with exceptions or unique scenarios

🎯 Realtor Takeaways

Don’t assume “big loan” means jumbo—check the high-balance limit for the county first

Staying within the high-balance conforming range means easier approvals, lower down payment options, and access to MI

Educate your clients: “You can go all the way up to $1.2M in many parts of California without leaving the conforming loan world.”

Watch out for border cases—going just $1 over the high-balance limit triggers jumbo underwriting and all the challenges that come with it

Remember, this is all about the LOAN size, not the purchase price. Easy to mix those up sometimes!

Reply