- GTG Weekly

- Posts

- 💸 What $200B for Bonds Means for Mortgage Rates

💸 What $200B for Bonds Means for Mortgage Rates

Mortgage Rates FALL ⬇️. AI Coffee Event Invite.

Issue 141 - Hello and Happy Tuesday.

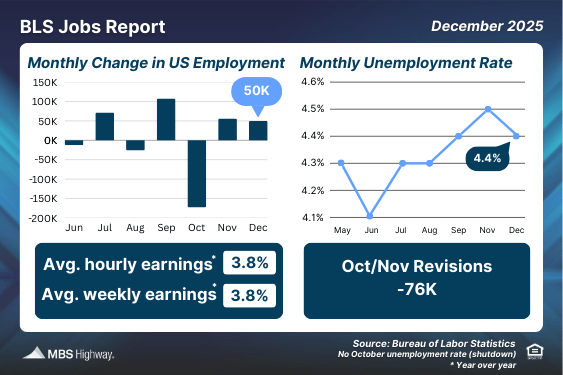

The latest BLS jobs report gave bond markets the cover they needed. Job growth slowed, revisions moved lower, and labor pressure continued to ease. That backdrop is why the $200B headline around mortgage bond buying actually moved markets, rather than being ignored.

When data and headlines line up, bonds respond first, and mortgage rates tend to follow.

Personal Note:

Saturday night was fun… had my first trip to the ER since I was 11. Took a Nerf dart directly to the pupil. No, I was not wearing safety goggles, yes, I know I should have been.

I am fine, my eye is fine. The doctor (who also has 8 and 10-year-old boys) sympathized, and basically laughed at me… which I 100% deserved, haha.

Needless to say, we now have a strict “put on your damn safety goggles” rule around the house.

BTW, great show (The Pitt on HBO)

TLDR (Too Long Didn’t Read) Summary

🤝 INDUSTRY - We’re hiring a Mortgage Processor… who do you know?

⬇️ RATES - Big moves DOWN

🤖 AI EVENT - Sonoma County Coffee and AI event invite.

📊 TECHNICALS - Soft Job Data

A big 2026 starts now

Most people treat this stretch of the year as dead time. But builders like you know it’s actually prime time. And with beehiiv powering your content, world domination is truly in sight.

On beehiiv, you can launch your website in minutes with the AI Web Builder, publish a professional newsletter with ease, and even tap into huge earnings with the beehiiv Ad Network. It’s everything you need to create, grow, and monetize in one place.

In fact, we’re so hyped about what you’ll create, we’re giving you 30% off your first three months with code BIG30. So forget about taking a break. It’s time for a break-through.

INDUSTRY

We’re Hiring: Corporate Mortgage Processor

We are adding a Corporate Mortgage Processor to the GTG Financial team located here in Santa Rosa, CA. This could become a hybrid or full-remote position.

This is not an entry-level role, but we could consider someone with the right attitude. This is not a high-chaos environment. We are looking for someone who takes ownership of files, communicates clearly, and takes pride in submitting clean, well-documented loans.

GTG Operations waiting for their next team mate…

If you have strong experience with Conventional, FHA, and VA loans, understand how a brokerage operates, and prefer structure over fire drills, this could be a great fit.

👉 Interested or know someone who would be a strong match?

Reply to this email or reach out directly. Discretion respected.

INTEREST RATES

Rates 📢 January 13th, 2026

10 Year T-Note 180-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

⬇️ Conv. | 5.990% / 6.031% | -.250% |

⬇️ Conv. HB | 6.125% / 6.164% | -.250% |

⬇️ JUMBO | 6.125% / 6.161% | -.125% |

⬇️ FHA 3.5% DP | 5.250% / 6.200% | -.375% |

⬇️ VA 0% DP | 5.250% / 5.479% | -.375% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Rates Update: Why the $200B MBS Move Matters

Last Thursday, the 8th, Donald Trump said he is instructing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities (MBS).

Here is what that actually means for mortgage rates, in plain terms.

What happens when $200B goes into MBS

📉 More buyers of mortgage bonds

When Fannie and Freddie buy MBS, demand goes up. Higher demand pushes MBS prices higher.📉 Higher MBS prices = lower mortgage rates

Mortgage rates move opposite MBS prices. As MBS prices rise, lenders can offer lower rates.📉 Mortgage spreads tighten

This helps reduce the gap between Treasury yields and mortgage rates, which has been unusually wide.

Why this is a big number

💰 $200B is meaningful

Prior QE programs buying roughly $40B per month had a noticeable impact on rates.

Even if this averages closer to $20B per month, it is still supportive for mortgage pricing.🏦 This targets mortgages directly

This is not about long-term Treasuries. It specifically supports housing and mortgage rates.

What we saw in the market so far

📊 MBS prices jumped immediately after the announcement

📊 Gains were partially tempered by the BLS Jobs Report

📊 Net result: mortgage bonds remain about 40 bps better than before the announcement

What this means for buyers and sellers

🏠 Rates have room to move lower

🔁 More refinance opportunities ahead if this continues

📈 Lower rates support demand and home values

Realtor Insight:

This creates a window where buyers can get in at today’s prices, benefit from potential appreciation, and still have a refinance opportunity later if rates continue to ease.

⚠️ CAUTION AHEAD: If this trend in rates continues and accelerates, it could lead to a price ramp-up as buyers stretch their newly gained buying power.

EVENT INVITE

Join us for Coffee and AI talk at the GTG Corporate office on January 23rd! (Limited Spaces)

Who: Glenn from GTG and Kim from Fidelity National Title.

What: Coffee hour to chat about AI in Mortgage and Real Estate.

When: 10 - 11 am, Friday, January 23rd, 2026.

Where: GTG Office - 1421 Guerneville Road, Suite 100, Santa Rosa, CA 95403.

Why: AI is creeping into EVERYTHING!

TECHNICALS

Soft Jobs Data

The trend did not change. The labor market is cooling, and housing supply is still struggling to grow. That combination matters for rates and pricing.

🧑🏭 Jobs Data: Softer Beneath the Headline

📉 50,000 jobs added, below expectations

🔻 Prior months revised down 76,000 jobs

🏥 Most gains came from health care and leisure, both seasonal and less cyclical

❗ Outside those sectors, job growth was effectively negative

Realtor takeaway

Slower job growth supports lower bond yields, which helps mortgage rates over time

This is not inflationary labor data

Source: Bureau of Labor Statistics

👀 What to Watch This Week

📊 CPI and New Home Sales

🏠 Existing Home Sales and Retail Sales

🧾 Weekly Jobless Claims

Markets are data-sensitive right now.

📈 Rates Snapshot

🏦 Mortgage bonds rallied after the President signaled $200B of MBS purchases

📊 10-year Treasury remains rangebound near 4.20%

Realtor takeaway

Mortgage rates follow bond demand, not Fed headlines

MBS support matters directly for rate sheets

Reply