- GTG Weekly

- Posts

- 💸 Venezuela Escalates. Rates Don’t Care.

💸 Venezuela Escalates. Rates Don’t Care.

Mortgage Rates Continue to HOLD ↔️, We're Hiring, Venezuela Market Reaction, Pending Home Sales Data.

Issue 140 - Hello and Happy Tuesday.

Welcome back!!

While we were away, rates really did not move much at all… even with the weekend shenanigans in South America. Housing quietly ended the year on stronger footing. Buyers are back, prices are holding, and the setup for early 2026 looks constructive.

Super Troopers - 2002

Personal Note:

We had a very merry Christmas and a happy New Year in the Groves’ house. Plenty of board and card games. Christmas movies, way too many sweets, and some really fun times together.

We are looking forward to an excellent 2026!

Jamie, the boys, and Oma are visiting after Christmas morning. |  The boys and I are in our stylish new Brock Purdy shirts. (Crocs not included). |

TLDR (Too Long Didn’t Read) Summary

🤝 INDUSTRY - We’re hiring a Mortgage Processor… who do you know?

↔️ RATES - Still in the solid 6% range.

📊 TECHNICALS - Pending sales data show a strong market ahead.

You could be wasting hundreds on car insurance

You could be wasting hundreds every year on overpriced insurance. The experts at FinanceBuzz believe they can help. If your rate went up in the last 12 months, check out this new tool from FinanceBuzz to see if you’re overpaying in just a few clicks! They match drivers with companies reporting savings of $600 or more per year when switching!* Plus, once you use it, you’ll always have access to the lowest rates; best yet, it’s free. Answer a few easy questions to see how much you could be saving.

INDUSTRY

We’re Hiring: Corporate Mortgage Processor

We are adding a Corporate Mortgage Processor to the GTG Financial team located here in Santa Rosa, CA. This could become a hybrid or full-remote position.

This is not an entry-level role, but we could consider someone with the right attitude. This is not a high-chaos environment. We are looking for someone who takes ownership of files, communicates clearly, and takes pride in submitting clean, well-documented loans.

GTG Operations waiting for their next team mate…

If you have strong experience with Conventional, FHA, and VA loans, understand how a brokerage operates, and prefer structure over fire drills, this could be a great fit.

👉 Interested or know someone who would be a strong match?

Reply to this email or reach out directly. Discretion respected.

INTEREST RATES

Rates 📢 January 6th, 202

10 Year T-Note 180-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 6.125% / 6.152% | -.000% |

⬇️ Conv. HB | 6.375% / 6.426% | -.125% |

⬇️ JUMBO | 6.250% / 6.298% | -.125% |

↔️ FHA 3.5% DP | 5.625% / 6.672% | -.000% |

↔️ VA 0% DP | 5.625% / 5.848% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

🌍 Venezuela and Market Reaction

🛢 Headlines around Venezuela briefly lifted geopolitical risk, mainly tied to potential oil supply disruptions.

📉 So far, bonds have stayed calm, suggesting markets see this as noise, not a supply shock.

🏦 When oil spikes, inflation fears usually push bond yields higher, which can pressure mortgage rates. That has not happened yet.

🧭 For now, mortgage rates remain driven far more by U.S. labor and inflation data than international headlines.

The big picture

🟢 Mortgage rates are opening 2026 largely unchanged, extending a stretch of stability that now spans roughly four months.

📊 The 10-year Treasury remains range-bound, which continues to limit day-to-day volatility in mortgage pricing.

🏡 This is one of the calmest rate environments we have seen in some time, despite a busy economic calendar.

What we are watching

👀 Labor data and housing reports later this week could create short-term movement, but nothing currently points to a breakout.

⚠️ January inflation resets can add noise, though the bond market appears prepared for it.

🧭 Until proven otherwise, rates remain in a holding pattern, not a new trend.

Realtor takeaway

📌 Rate stability makes it easier to keep clients focused on price, negotiations, and timing, rather than rate fear.

📌 Predictable payments reduce last-minute surprises during escrow.

📌 Early 2026 conditions are more supportive of deal flow than headlines might suggest.

TECHNICALS

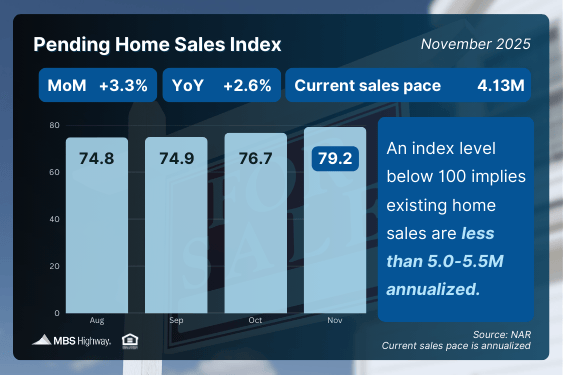

📈 Pending Home Sales Jump in November

Housing data closed out the year on a stronger note than expected. Buyer activity improved, home prices showed early signs of re-accelerating, and the labor market stayed steady despite seasonal noise.

Pending Home Sales rose 3.3% month over month, the strongest reading in nearly three years

Contract signings were also up 2.6% year over year

This typically leads closed sales by 30–60 days

Why this matters for Realtors:

🟢 This supports stronger closings in January and February

🟢 Buyers are clearly re-engaging as affordability stabilizes

🟢 Momentum heading into the spring selling season looks healthier than expected

👷♂️ Unemployment Claims Stay Low

Initial claims fell to 199,000, below expectations

Continuing claims also declined to 1.866 million

Seasonal timing around the holidays likely played a role

Why this matters for Realtors:

🟢 Job stability supports buyer confidence

🟢 No signs yet of labor stress that would pressure home prices

🟢 The consumer remains resilient heading into 2026

👀 What to Watch This Week

Wednesday: Job Openings and ADP private payrolls

Thursday: Weekly jobless claims

Friday: Full employment report including payrolls and unemployment rate

Delayed new home construction data for September and October also drops Friday

These reports will heavily influence bond markets and rate sentiment early in the year.

Reply