- GTG Weekly

- Posts

- 💸 The Fed can’t agree on what’s next

💸 The Fed can’t agree on what’s next

Mortgage Rates Down ⬇️. GOLD RUSH Trip. Fed Split Decision.

Issue 132 - Hello and Happy Tuesday.

After finally cutting rates in September, the Fed now finds itself divided on what to do next. The latest meeting minutes show growing tension between members who want to keep fighting inflation and others who worry the job market is starting to crack.

With key economic data delayed by the government shutdown, the next Fed meeting at the end of the month could set the tone for how mortgage rates move heading into the holidays.

Personal Note:

Grayson is in 4th grade this year, and those of you here in CA know that means California History is a huge subject.

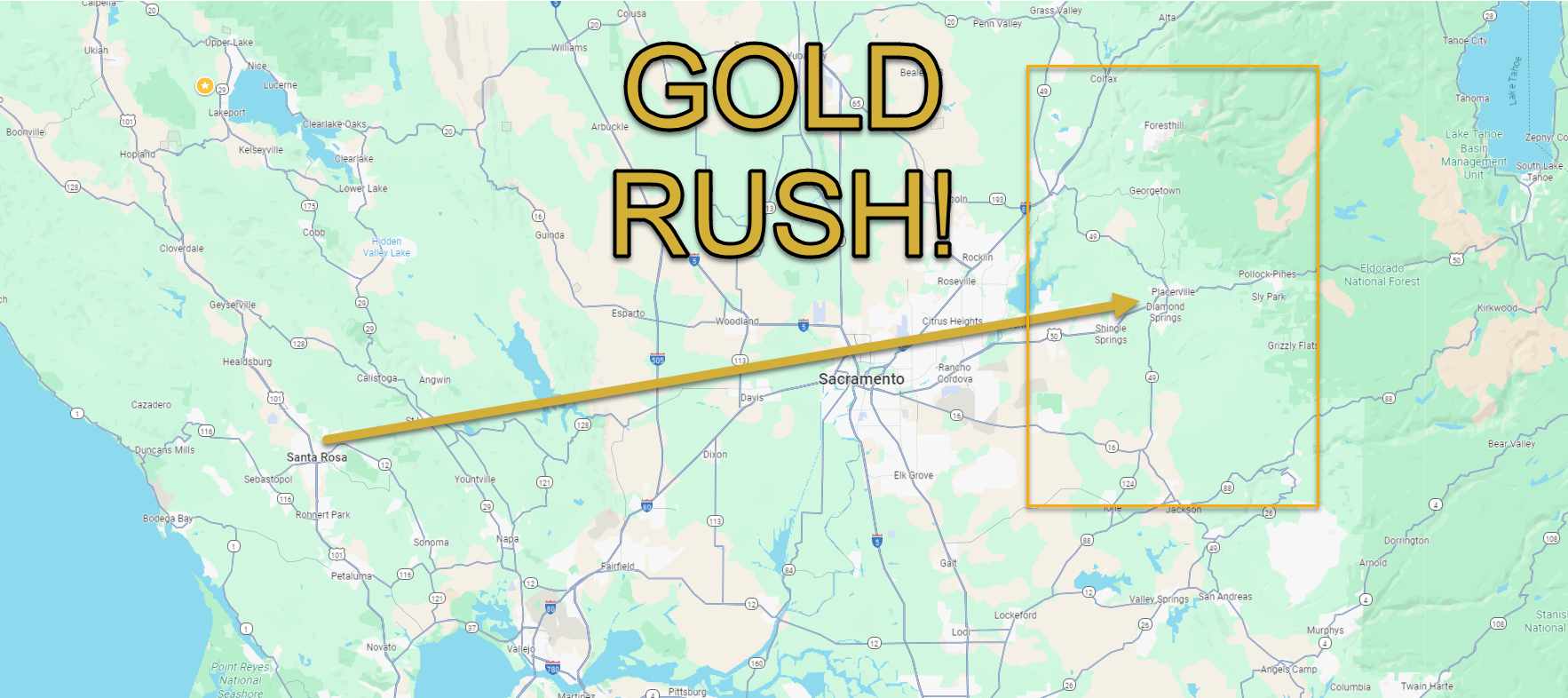

We decided to take the boys about 2.5 hours North East to El Dorado County to learn about the CA Gold Rush. Really fun trip, timed the weather perfectly. Yes, we plan on doing something for the CA Missions as well, IYKYK.

It was fascinating learning about how the gold discovery helped shape CA becoming a State in 1850, the politics behind this move right after the Mexican-American War, and the lead-up to the Civil War. Yes, I made the family listen to history podcasts on the drive to prime them for the history lesson, haha.

We rounded out the trip with a stop at Sutter's Fort (Sutter’s Mill was where the gold was found) in Sacramento. Very cool to tie it all together.

Stayed at the Carey Hotel (over 170 years old) in Placerville for a few nights.

Headed to the State Park, where gold was discovered in January 1848.  Gray learning how to pan for gold.  Preparing to enter the Goldbug mine.  Stopped at Fort Sutter in Sacramento on the way home. |  Gray is standing on the site where gold was discovered on January 24th, 1848.  JJ panning in the American River.  In the Goldbug mine, taking the tour. |

TLDR (Too Long Didn’t Read) Summary

⬇️ RATES - Rates are feeling the shutdown, in a good way.

📊 TECHNICALS - The Fed is divided on its next steps.

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

INTEREST RATES

Rates 📢 October 14th, 2025

10 Year T-Note 90-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

⬇️ Conv. | 6.125% / 6.169% | -.250% |

↔️ Conv. HB | 6.500% / 6.551% | -.000% |

⬇️ JUMBO | 6.125% / 6.163% | -.125% |

⬇️ FHA 3.5% DP | 5.625% / 6.672% | -.125% |

↔️ VA 0% DP | 5.625% / 5.848% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

The ongoing government shutdown has actually worked in favor of mortgage rates, at least for now. When the government closes, markets grow nervous about slower spending, missed paychecks, and broader economic drag. That uncertainty often sends investors looking for safer assets like U.S. Treasury and Mortgage Bonds.

💡 Here’s what that means:

📉 Bond yields fall when investors pile in for safety.

🏠 Mortgage rates follow, since they’re closely tied to bond performance.

💬 As long as the shutdown continues, rates could stay in this softer range, but once a resolution is reached, expect volatility as markets rebalance.

Realtor Insight:

Lower rates mean renewed affordability for sidelined buyers. Encourage clients to re-check their pre-approvals. A small dip in rates can open up $15K to $25K in extra buying power, depending on the loan size.

TECHNICALS

Fed Split Widens, Markets Wait for Clarity

The Fed finally cut rates in September… but the latest meeting minutes show deep division on what comes next. Here’s what it means for mortgage rates 👇

🏦 Inside the Fed’s Divide

At the September 17 meeting, the Fed delivered its first 25-bps rate cut of 2025 after holding steady all year. But the minutes reveal no clear consensus on whether that was the start of a broader easing cycle or a one-off move.

💡 The split looks like this:

🧊 Hawks worry inflation’s still too hot and want to pause before cutting again.

🕊️ Doves point to a cooling job market and argue for faster action to avoid a deeper slowdown.

“There’s no risk-free path forward.”

The challenge is that key economic data has been delayed by the government shutdown, leaving policymakers flying half-blind ahead of the next meeting on October 29.

📉 Why It Matters for Mortgage Rates

🔹 Mortgage rates track the bond market, not the Fed directly, but bond investors watch the Fed closely.

🔹 A divided Fed = market uncertainty, which tends to keep rates range-bound short-term.

🔹 If jobs data weakens or inflation cools once reports resume, investors could price in another cut, pushing mortgage rates lower heading into year-end.

🧭 Realtor Insight

Now’s the time to prep your buyers.

Rates are stabilizing — but the next meaningful move will hinge on jobs and inflation data once it finally hits the wires.

Encourage clients to stay loan-ready; if yields dip, refi-level pricing could appear briefly before the holidays.

Reply