- GTG Weekly

- Posts

- 💸 The Calm Before the Cut?

💸 The Calm Before the Cut?

Mortgage Rates Holding Steady ↔️, Even with Japan spiking the bond market yesterday. Thanksgiving brisket, new loan limits, and pending home sales.

Issue 138 - Hello and Happy Tuesday.

This week kicked off with a surprise from Japan that sent global bond markets moving. Their central bank hinted it may finally pull back on years of heavy bond buying, which pushed yields higher overseas and spilled into our markets early Monday.

Under normal conditions, lenders would have already tightened pricing, but so far they’ve held steady, likely waiting to see what this week’s PCE inflation report shows.

With the Fed making its December rate cut decision next week, the market is bracing for a busy stretch that could shape how we close out the year.

Personal Note:

I wanted to change things up this year for Thanksgiving. So I decided to smoke a brisket. Knowing we were meeting mid-afternoon at the in-laws meant I needed to do an overnight smoke (12+hours).

I hadn’t done this in years and forgot that it was basically like having a newborn baby that keeps waking you up, lol.

All came out successful for dinner, and everyone loved it. Maybe a Traeger Smoker is in my future… You know, the easy bake oven of smoking meats.

Throwing on the brisket at 8:15 pm |  Mid-smoke, babysitting at 2am. |

TLDR (Too Long Didn’t Read) Summary

↔️ RATES - Still stable. Bonds are taking a little beating this week.

💵 INDUSTRY - New loan limits released 11/25.

📊 TECHNICALS - Home sales are UP (across the nation).

Are You Ready to Climatize?

Climatize is an investment platform focused on renewable energy projects across America.

You can explore vetted clean energy offerings, with past projects including solar on farms in Tennessee, grid-scale battery storage in New York, and EV chargers in California.

Each project is reviewed for transparency and offers people access to fund development and construction loans for renewable energy in local communities.

As of November 2025, more than $13.2 million has been invested through the platform across 28 renewable energy projects. To date, over $3.6 million has already been returned to our growing investor base. Returns are not guaranteed, and past performance does not predict future results.

Check out Climatize to explore clean energy projects raising capital. Minimum investments start with as little as $10.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

INTEREST RATES

Rates 📢 December 2nd, 2025

10 Year T-Note 90-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 6.125% / 6.152% | -.000% |

↔️ Conv. HB | 6.500% / 6.551% | -.000% |

↔️ JUMBO | 6.375% / 6.397% | -.000% |

↔️ FHA 3.5% DP | 5.625% / 6.672% | -.000% |

↔️ VA 0% DP | 5.625% / 5.848% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

🟢 Rates are flat for now

Pricing hasn’t reacted yet, even though the 10-year jumped this morning. Lenders usually wait to see if the move sticks before repricing.

📈 The 10 year is rising fast

Global bond moves, especially from Japan, pushed yields higher today. If those levels hold, mortgage rates often follow.

📌 Global shock from Japan

Bank of Japan Governor Ueda signaled they may hike rates this month, which sent Japanese government bond yields to their highest levels in more than a decade.

Source: CNBC (Dec 1, 2025) https://www.cnbc.com/2025/12/01/us-treasury-yields-traders-increase-bets-on-fed-rate-cut-.html

⏳ This creates a short timing window

Buyers may have access to slightly better pricing today than they could later this week if lenders adjust.

🏡 Impact on buyers

Higher yields translate into higher payments, which can shrink approval amounts and slow decision-making for rate-sensitive clients.

🏠 Impact on sellers

Rising rates reduce the qualified-buyer pool. In a season with fewer listings already, a rate bump can slow activity even more.

🔎 Bottom line

This is one of those mornings where the bond market is moving first and mortgage rates may play catch-up. Staying ahead of it helps protect deals and set the right expectations.

TECHNICALS

Pending Home Sales Rise in October📄

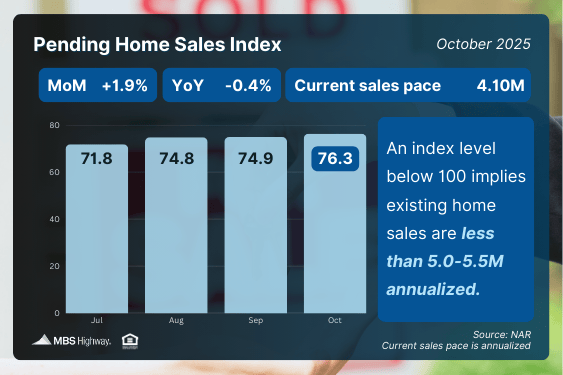

Pending Home Sales rose 1.9 percent from September to October, reaching the strongest pace of 2025, per NAR.

📉 Contract signings were down only 0.4 percent year over year, which is the closest we’ve been to positive territory all year.

🏁 Why this matters: Pending sales lead closings by 30 to 60 days. This jump suggests higher closed volume through December and January. Rates have improved, inventory is up, and buyers who were on the sidelines are stepping back in.

💡 Realtor Insight: Use this as a talking point during listing appointments. Sellers are no longer competing with the dead bottom of the market. Buyers are showing up again, and signed contracts confirm it.

What to Watch This Week

📊 ADP Jobs Report (Wed):

A fresh look at private-sector hiring. With continuing jobless claims trending higher, this will help confirm whether the labor market is cooling.

🧾 Jobless Claims (Thu):

Initial claims remain low, but continuing claims are elevated. Another increase would reinforce the slowdown narrative the Fed is watching closely.

🔥 September PCE Inflation (Fri):

The big one. This is the Fed’s preferred inflation measure and has been delayed due to the shutdown. Any softening here supports the recent dip in rates and could add momentum heading into December.

💡 Realtor Insight:

This week is light on volume but heavy on meaning. All three reports tie directly into rate expectations. Softer data tends to support lower rates, which keeps buyers engaged even as we move deeper into the seasonal slowdown.

Reply