- GTG Weekly

- Posts

- 💸 Rates Jump on Global Noise

💸 Rates Jump on Global Noise

Mortgage Rates JUMP ⬆️. AI Coffee Event Invite. 10th Birthday, Hired Processor, EU Tariff Threats.

Issue 142 - Hello and Happy Tuesday.

CPI came in right on target, but rates still moved higher. The pressure isn’t from inflation. It’s coming from renewed EU tariff threats and bond market moves out of Japan. With this Tuesday feeling like a Monday, markets are still finding their footing.

Personal Note:

Milestone alert. Grayson had his 10th birthday last Thursday. Finally got that new bike he’s been begging asking for. Shoutout to Breakaway Bikes in Santa Rosa, great service!

Now he can keep up with his brother on adventures. Which, then JJ pulled me aside and said, “Dad, Gray’s bike is faster than mine now…” so of course Jamie and I got a chuckle out of that as the sibling see-saw power struggle shifted (again) haha. |  |

JJ started his Flag Football league over the weekend, super fun. Pictures to follow next week!

TLDR (Too Long Didn’t Read) Summary

⬆️ RATES - Pop on Japan bonds and EU tariff threat (over Greenland).

🤖 AI EVENT - Local Coffee and AI event invite. ONLY 3 SPOTS LEFT!

📊 TECHNICALS - Inflation inline with expectations.

INTEREST RATES

Rates 📢 January 20th, 2026

10 Year, 3 Month Snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 5.990% / 6.031% | -.000% |

⬆️ Conv. HB | 6.375% / 6.408% | +.250% |

⬆️ JUMBO | 6.250% / 6.274% | +.125% |

⬆️ FHA 3.5% DP | 5.500% / 6.444% | +.250% |

⬆️ VA 0% DP | 5.500% / 5.723% | +.250% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

Giphy

📈 Rates Moved Higher. Here’s Why.

Mortgage rates pushed up last week due to global bond pressure, not housing fundamentals.

🌍 Global yields jumped

Rising yields overseas, especially out of Japan, pushed global bond rates higher. When global investors can earn more elsewhere, US bonds get sold.💣 Tariff headlines rattled markets

New tariff threats toward the EU triggered a risk-off move. Markets are pricing in the chance of higher inflation, even though nothing is finalized yet.🏦 Mortgage bonds sold off

As Treasuries sold off, Mortgage-Backed Securities followed. That directly translates to higher mortgage rates.📉 Technical break lower

Mortgage bonds broke below key support levels, accelerating the move higher in rates over a short period of time.

Big picture:

Rates did not rise because demand is strong or housing is overheating. This was a macro-driven move tied to global bonds and headlines, not buyers.

EVENT INVITE

Join us for Coffee and AI talk at the GTG Corporate office on January 23rd! (ONLY 3 Spots LEFT)

Who: Glenn from GTG and Kim from Fidelity National Title.

What: Coffee hour to chat about AI in Mortgage and Real Estate.

When: 10 - 11 am, Friday, January 23rd, 2026.

Where: GTG Office - 1421 Guerneville Road, Suite 100, Santa Rosa, CA 95403.

Why: AI is creeping into EVERYTHING!

Investors see ANOTHER return on Masterworks (!!!)

That’s 3 sales this quarter. 26 sales total.

And the performance?

14.6%, 17.6%, and 17.8% → The three most representative annualized net returns.

(See all 26 at Masterworks.com)

Masterworks is the biggest platform for investing in an asset class that hasn’t moved in lockstep with the S&P 500 since ‘95.

In fact, the market segment they target outpaced the S&P overall in that time frame.*

Not private equity or real estate… It’s contemporary and post war art. Crazy, right?

Masterworks investors are typically high net worth, but the point is that you don’t need to be a capital-B BILLIONAIRE to invest in high-caliber art anymore.

Banksy. Basquiat. Picasso and more.

80+ of the world’s most attractive artists have been featured.

511+ artworks offered

$67.5mm paid out as of December 2025

$2.3mm+ average offering size

Looking to update your investment portfolio before 2026?

*Masterworks data. Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

INDUSTRY

We’re Hiring Excited: Corporate Mortgage Processor Position Has Been Filled!

We have filled the open processing position by hiring Steph Wright. We are very excited to have her as part of the GTG team moving forward!

TECHNICALS

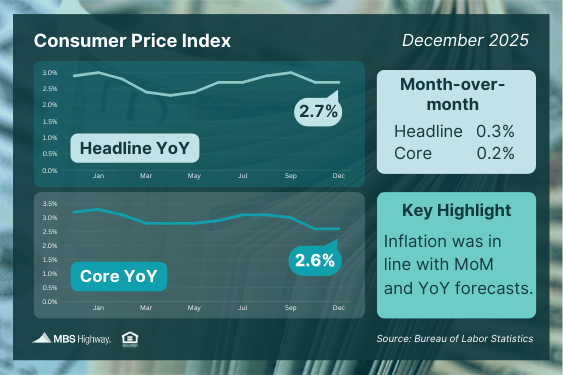

Inflation Check: No Surprises, No Victory Lap

📊 Consumer inflation came in right in line with expectations

📉 Core inflation stayed at 2.6%, the lowest level since early 2021

🏠 Shelter costs are still the problem:

They make up about one-third of headline inflation

Nearly half of core inflation

Bottom line

Inflation is cooling, but not fast. Housing costs are keeping pressure on the numbers, which limits how aggressive the Fed can be with future rate cuts.

Realtor insight

This is the type of inflation data that helps rates stay stable, but it does not force lenders to move pricing meaningfully lower on its own.

What to Watch This Week

📈 PCE Inflation (October & November)

This is the Fed’s preferred inflation measure and matters more than CPI.🏡 Pending Home Sales (December)

A forward-looking signal for spring activity.👷 Weekly Jobless Claims

Markets are watching for signs the labor market is weakening further.📊 Final Q3 GDP

Backward-looking, but still part of the Fed’s full economic picture.

Why this matters

Rates tend to wait for confirmation. If PCE stays calm and jobs soften further, bonds may finally get permission to move lower. If not, rates likely stay choppy.

Reply