- GTG Weekly

- Posts

- 💸 No Inflation Surprise, No Rate Cut Either

💸 No Inflation Surprise, No Rate Cut Either

Mortgage Rates HOLD ↔️ ahead of the Fed meeting. No one is expecting a Prime Rate cut this week. PCE data all but confirms Fed holding still this month. JJ Flag football.

Issue 143 - Hello and Happy Tuesday.

Inflation landed exactly as expected last week, keeping the Fed in wait-and-see mode. The Federal Reserve meets Tuesday and Wednesday, and no one expects a cut to the prime rate at this meeting.

Personal Note:

JJ has had a blast playing flag football on Sunday mornings. The Gators are 2-0! They are taking no prisoners on the gridiron.

Been really fun to see all the kids pick up the basics over the past few weeks. Should be a fun next 6-7 weeks of watching them all learn more about football!

“I want 49 for the 49ers.” Love it.  Team photo op! |  Mr. Football.  Giphy - Gator - IYKYK |

TLDR (Too Long Didn’t Read) Summary

↔️ RATES - All quiet on the Western rate front.

📊 TECHNICALS - PCE plays along. No surprises.

INTEREST RATES

Rates 📢 January 27th, 2026

10 Year T-Note 180-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 5.990% / 6.031% | -.000% |

↔️ Conv. HB | 6.125% / 6.164% | -.000% |

⬇️ JUMBO | 6.125% / 6.161% | -.250% |

↔️ FHA 3.5% DP | 5.250% / 6.200% | -.000% |

↔️ VA 0% DP | 5.250% / 5.479% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

⏱️ Rates in 60 Seconds

Mortgage rates were volatile last week but finished mostly unchanged, with Jumbo improving.

What happened 📊

🌍 Global headlines caused intraday bond swings

Tariff threats

Japanese central bank headlines

Geopolitical noise

📉 Bonds sold off early, then recovered

🧾 Weekly takeaway: noise during the week, flat to better by Friday

Where rates landed

Conventional: ~5.99% (flat week over week)

Jumbo: ~6.125% (down ~0.25%)

FHA and VA: largely unchanged, VA slightly better

What matters now 🧠

Mortgage bonds remain supported above short-term levels

The 10-year Treasury is range-bound, not breaking higher

Markets are reacting fast to headlines, then mean-reverting

Realtor Insight 🏡

Despite scary daily moves, weekly pricing stayed steady and Jumbo actually improved. This supports buyers who are rate-sensitive at higher price points and reinforces that timing the headlines is harder than watching the trend.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

TECHNICALS

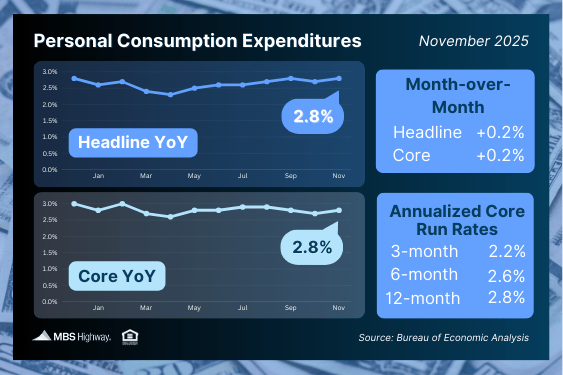

PCE Inflation: Right on Script

The Fed’s preferred inflation gauge did exactly what it was supposed to do: nothing surprising.

🔍 The PCE Read

Headline PCE: +0.2% month-over-month

Core PCE: +0.2% month-over-month

Annual pace: 2.8%

This is the inflation measure the Federal Reserve cares about most when setting policy.

🧠 Why This Matters

Monthly inflation is cooling, not collapsing

Early-2025 hot readings are about to roll off the 12-month math

That sets the stage for better-looking inflation data ahead, even without major economic slowdown

Fed Chair Jerome Powell has been clear that inflation progress must be sustained, not just cooperative for a month or two.

🏦 What This Means for Rates

This data does not force the Fed to cut

It does keep cuts on the table later in the year

Mortgage rates react more to bond markets and inflation trends than the Fed Funds rate itself

Translation: this helps rates stabilize, but it doesn’t unlock a straight line down.

🏠 Realtor Insight

PCE behaving is a necessary condition for lower mortgage rates

It is not sufficient on its own

Expect rates to stay range-bound unless inflation continues to behave through Q1

Reply