- GTG Weekly

- Posts

- 💸 Inflation Up... But Not Because of Tariffs

💸 Inflation Up... But Not Because of Tariffs

Mortgage Rates Down ⬇️ . Week Off - S.F. Day Trip, Beach Visit, Recyling Profits, CPI & Tariffs.

Issue 124 - Hello and Happy Tuesday.

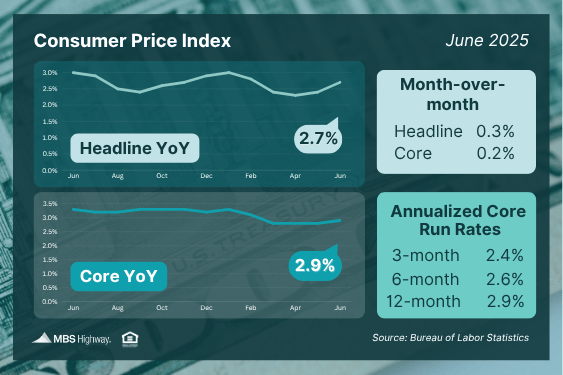

Rates didn’t love the latest CPI print, but it wasn’t the tariff-driven spike everyone expected. Overall, we were able to weather the storm. We’re breaking down what actually moved inflation, why it matters for buyers, and what this week’s housing data could mean for your listings.

Personal Note:

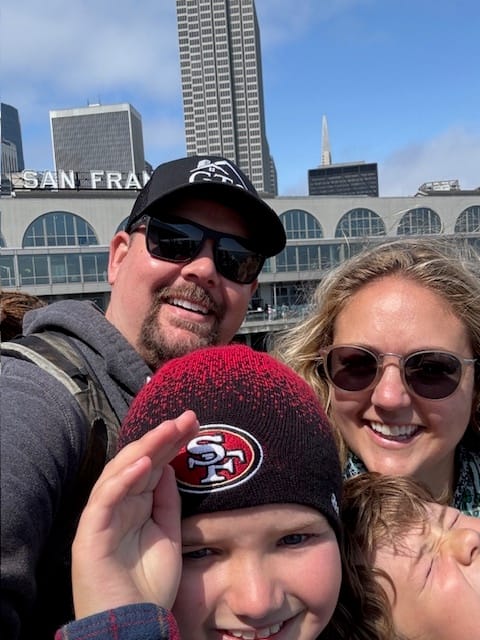

In the previous week (on the 12th) we took the kids to the City (San Francisco) to see Pier 39. Those who have been there know it is a giant tourist trap. Now that we've seen it (Jamie and I hadn’t been there in over 25 years), we’re good, lol. Regardless, it was fun to take the boys on the ferry for the first time. Next time it will be directly to a Giants game.

Last week I was out. Took some personal time via a “Staycation” with the Family.

The boys had a flag football camp during the day, and Jamie and I were able to run around and get some house projects/chores done.

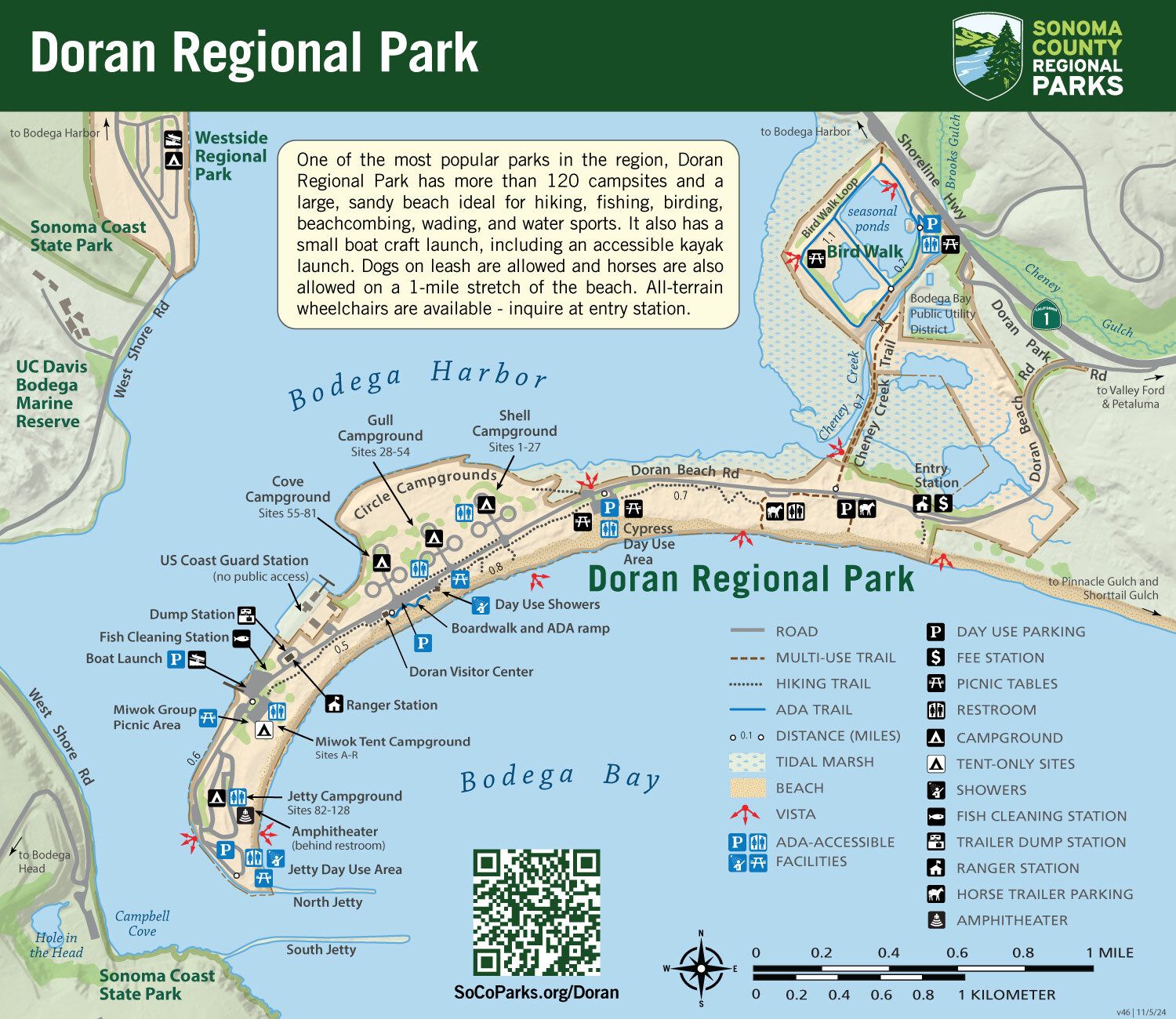

We went to the beach over the weekend and enjoyed the beautiful weather. Both boys got a taste of boogie boarding!

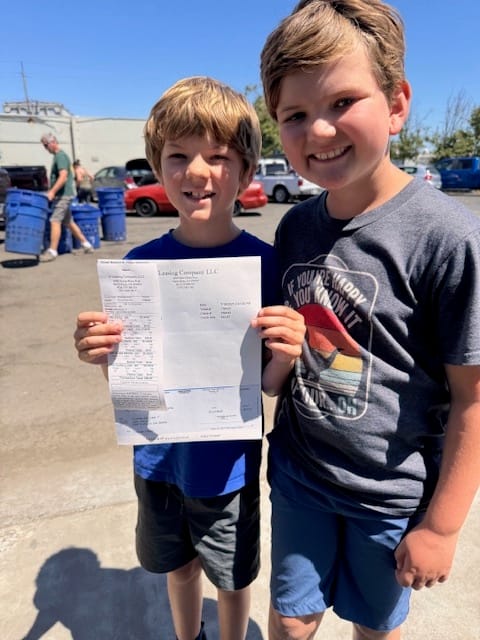

HUGE proud dad moment, JJ (7) has been working hard collecting cans, bottles, plastic from neighbors and family over the past 3-4 weeks. He was super interested once he found out you can turn the recycling in for money, lol. He enlisted his older brother’s help, dragging a wagon around the neighborhood collecting.

Well, we took his haul to the Recycling center, and he had a gross revenue of $50! So proud of his incredible hard work. He’s already learning how a Profit & Loss statement will work. Not a big fan of the “costs” associated with running a business. Wait until he finds out there are more taxes than just a “dad tax”.

Enjoying Doran Beach  Grayson (9)  Making sure everything is ready for processing.  Hard-earned money! |  Doran Regional Park - Sonoma County  JJ (7)  Sorting the haul.  Pulling into the Port of SF |

TLDR (Too Long Didn’t Read) Summary

⬇️ RATES - Move downward.

📊 TECHNICALS - CPI came in last week.

INTEREST RATES

Rates 📢 July 22nd, 2025

10 year 3 - Month Snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

⬇️ Conv. | 6.625% / 6.663% | -.125% |

⬇️ Conv. HB | 6.875% / 6.907% | -.125% |

⬇️ JUMBO | 6.500% / 6.528% | -.125% |

↔️ FHA 3.5% DP | 5.999% / 6.925% | -.000% |

↔️ VA 0% DP | 6.125% / 6.371% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

📉 Rates Tick Down as Bond Market Holds Its Ground

After weeks of bouncing around, mortgage rates moved slightly lower to start the week. The drop is tied to strength in the bond market—specifically, mortgage-backed securities finding support at key technical levels. This stability has allowed rates to improve modestly, though they’re still sensitive to the next wave of economic news.

📦 Tariff & Inflation Headlines Still a Wildcard

Markets are watching closely as the August 1 tariff deadline approaches. New tariffs on EU and Mexican goods could add to inflation pressures—something the bond market hates. If inflation data comes in hotter than expected, or tariff news spooks investors, we could quickly see rates reverse course and head higher again.

📊 Jobs Data Will Be the Next Big Driver

Initial jobless claims and Friday’s Durable Goods Orders could push the Fed’s hand on future policy. If labor market data shows unexpected strength, the bond market may react by pricing in fewer rate cuts—which typically pushes mortgage rates up. On the flip side, signs of a slowdown could give rates more room to fall.

💡 Realtor Insight

This dip in rates may not stick. It’s a great moment to re-engage pre-approved buyers or those on the sidelines. Even a small improvement in rates can boost their buying power—but tariff headlines or inflation data could reverse the trend fast.

TECHNICALS

CPI Pops, But Tariffs Didn’t Do the Damage

📊 Consumer Prices Climb in June… But Not for the Reason You Think

Inflation edged up last month — but the big fear (tariffs causing a spike) didn’t fully materialize.

CPI rose 0.3% in June

Year-over-year inflation moved up to 2.7% (from 2.4% in May)

Core CPI (excludes food and energy) rose 0.2%, bringing the annual rate to 2.9%

🔍 What actually caused it?

Energy prices jumped 0.9% ⚡

Food costs up a modest 0.3% 🍎

Tariffs had a lighter impact than expected

Home furnishings and clothing rose

Car prices fell 🚗

Food prices stayed relatively tame

🏠 Shelter is still the biggest contributor to inflation. Housing costs climbed again in June, but the annual growth rate dropped slightly to 3.8%.

🚨 Why This Matters for Rates

Sticky inflation = Sticky mortgage rates.

But here’s the nuance: the jump in June was partly due to lower 2024 numbers rolling off the 12-month average, not just price acceleration today.

Realtor Insight:

Inflation didn’t surge because of tariffs — and that’s good news for long-term rate trends. But the Fed won’t ease up unless inflation cools further. Your buyers still need to lock strategically.

🗓️ What to Watch This Week

We’ve got big housing reports and a key labor update coming up:

📅 Wednesday – Existing Home Sales (June)

📅 Thursday – New Home Sales (June)

📅 Thursday – Weekly Jobless Claims

These could move the needle on sentiment and rates. If home sales are weak but jobless claims fall again, the Fed may hold steady — not cut.

💡 Final Take

Inflation's still annoying, but not runaway. Tariffs didn’t break the bank. The Fed is in “wait and see” mode — and so are rates.

📣 Now’s the time to educate buyers: We’re not out of the woods, but inflation isn’t derailing everything either. Locking in now with a refi strategy later is still a winning play for many.

Reply