- GTG Weekly

- Posts

- 💸 Fresh Data and Fresh Loan Limits for 2026

💸 Fresh Data and Fresh Loan Limits for 2026

Mortgage Rates Holding Steady ↔️. New Loan Limits. Jobs data pouring in. Wine Country trip.

Issue 137 - Hello and Happy Tuesday.

The government is finally back open, data is starting to flow again, and the market is trying to get its footing after weeks of mixed signals. On top of that, the new 2026 loan limits were just announced, giving buyers a little more room to work with as we head into the slower holiday stretch.

Some will see this season as fewer listings and less momentum. Others will see opportunity in lower competition and expanding loan limits. It all depends which side of the fence your clients stand on.

Personal Note:

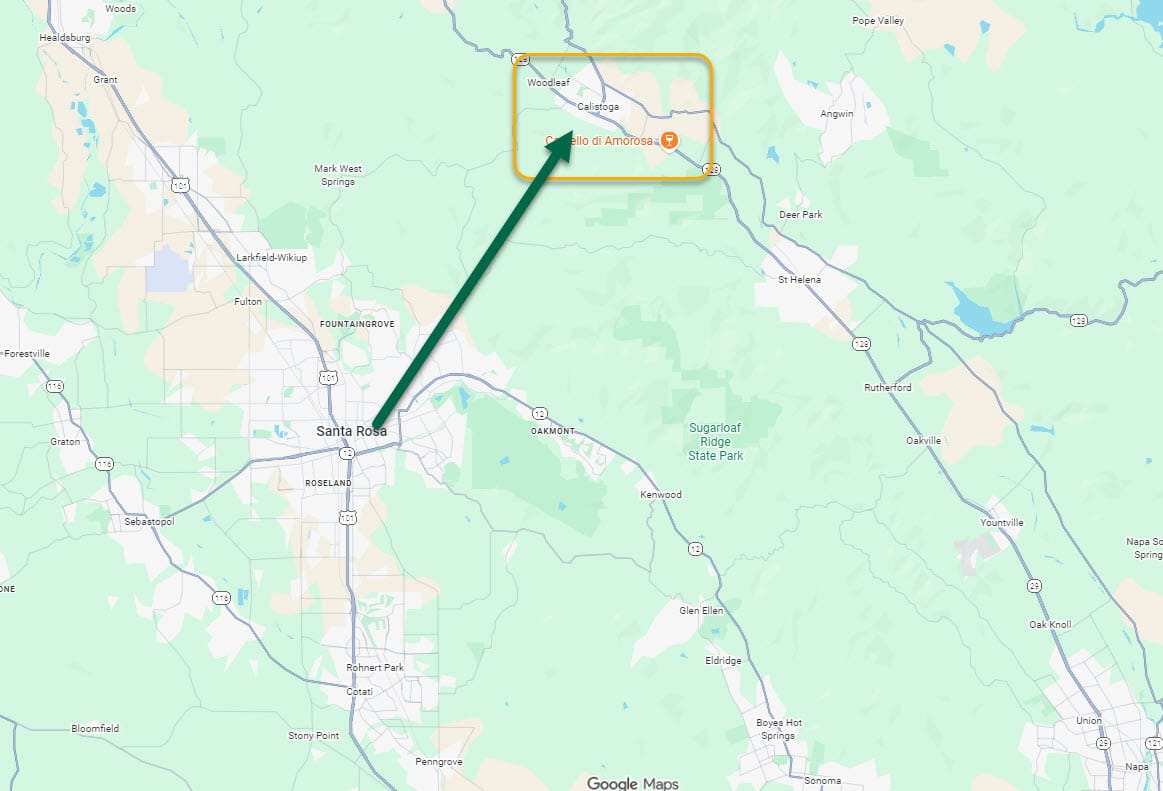

Jamie and I were able to create a long weekend and getaway for her 40th in beautiful Calistoga, CA, in our neighboring Napa Valley.

We had some good wine, great food, and a super relaxing reset together as we head into the holidays. I know it sounds mushy, but I want to recognize Jamie here… I cannot accomplish half of what I do in my career without her continued support. She is my rock!

Rode our bikes from Calistoga to the famous Napa sign.

Natural mineral pool, 100 degrees! |  Arriving at Indian Springs resort |

Only about 35-40 minutes from home base in Santa Rosa.

TLDR (Too Long Didn’t Read) Summary

↔️ RATES - Still stable. Starting a trend(?)

💵 INDUSTRY - New loan limits released 11/25.

📊 TECHNICALS - Mixed data.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

INTEREST RATES

Rates 📢 November 25th, 2025

10 Year T-Note 90-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 6.125% / 6.152% | -.000% |

↔️ Conv. HB | 6.500% / 6.551% | -.000% |

⬆️ JUMBO | 6.375% / 6.397% | +.125% |

↔️ FHA 3.5% DP | 5.625% / 6.672% | -.000% |

↔️ VA 0% DP | 5.625% / 5.848% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

📅 A flood of data is finally coming

With the government reopened, key reports like CPI, PCE, jobs, and QCEW are all stacking up in the days leading into the December 10 Fed meeting. Traders will finally have something real to trade on after weeks of blind guessing.

📉 We may be watching the same pattern repeat

Before the last two Fed cuts, bonds dropped early as markets baked in the cut, then reacted again after the announcement. This current slide in the 10-year looks very similar. The question is whether the Fed will follow the script again.

⌛ But this time feels different

Because the shutdown delayed so much economic data, the Fed will walk into this meeting without the full picture. That raises more uncertainty than the last few cuts and is why this decision is the most debated one of the cycle.

🎯 Realtor Insight

If rates drift lower into December, buyers will get a cleaner path to shop with confidence. But the reaction after the Fed meeting could create a quick window of opportunity. Keep active buyers close and be ready to run numbers fast.

TECHNICALS

Mixed Jobs Data

Will the September Jobs Report Lead to a Fed Pause? 🧭

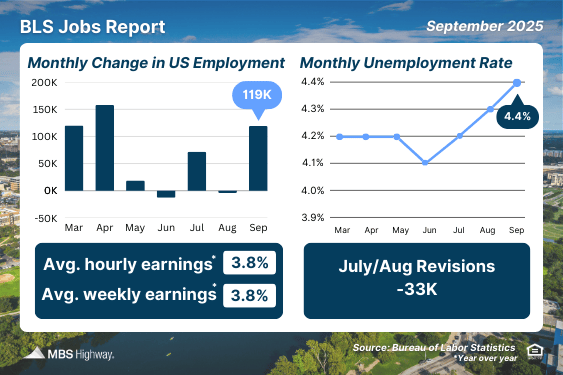

September added 119,000 jobs, beating the 50,000 forecast. But revisions to July and August pulled earlier numbers down, leaving August with a small 4,000 job loss. The unemployment rate also moved from 4.3 percent to 4.4 percent.

The bigger issue is timing. Because of the shutdown, the October jobs report is incomplete and will not include an unemployment rate. The full November report will not come out until December 16, which is after the Fed meets on December 9 to 10.

Powell and several Fed members have said repeatedly that another December rate cut is not guaranteed. With mixed jobs data and no new unemployment update before the meeting, the odds of a pause are rising.

Why this matters for real estate

📉 A Fed pause may keep mortgage rates from dropping quickly.

📅 Limited data means markets stay choppy until mid December.

🏠 Buyers waiting for confirmation of lower rates may stay on the sidelines a bit longer.

Jobless Claims Point to Slower Hiring 💼

Initial jobless claims stayed between 220,000 and 235,000 in October and November. Continuing claims remained above 1.9 million every week, most recently at 1.974 million.

What this means

High continuing claims tell us people are taking longer to find new jobs. That is a sign of a cooling labor market.

Realtor Insight

⚠️ Cooler job markets can slow buyer confidence, but they also help ease inflation, which supports lower mortgage rates over time.

What to Look for This Week 📅

Tuesday brings several important releases:

📊 September wholesale inflation

🛍️ September retail sales

🏠 Case Shiller home price data

🏘️ FHFA home price index

📝 Pending Home Sales from NAR

These updates will help shape expectations going into the December Fed meeting.

Reply