- GTG Weekly

- Posts

- 💸 Fed Watch

💸 Fed Watch

Mortgage Rates Holding Steady ↔️. All eyes on the Fed press conference after an anticipated 25bps rate cut tomorrow.

Issue 134 - Hello and Happy Tuesday.

Markets have already priced in a 25-basis-point cut at tomorrow’s Fed meeting, but the Fed may hold steady.

🔥Hot Take (from Mark Wilson at GTG Financial) With the government still shut down, the data they rely on to make those decisions hasn’t been coming in. That could be enough reason for them to wait until they have a clearer read on the economy.

Anchorman: The Legend of Ron Burgundy / 2004

The bond market isn’t waiting. Also, they don’t know who Mark Wilson is. Traders already expect a cut, which has kept yields and mortgage rates steady heading into tomorrow’s decision.

Personal Note:

Halloween is this Friday! Stand by for fun pictures. We are going Star Wars again, but switching up characters.

TLDR (Too Long Didn’t Read) Summary

↔️ RATES - Rates hold breath ahead of Fed presser tomorrow.

📊 TECHNICALS - CPI soft ahead of Fed.

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

INTEREST RATES

Rates 📢 October 28th, 2025

10 Year T-Note 90-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 6.125% / 6.169% | -.000% |

↔️ Conv. HB | 6.500% / 6.551% | -.000% |

⬆️ JUMBO | 6.250% / 6.265% | +.125% |

↔️ FHA 3.5% DP | 5.625% / 6.672% | -.000% |

↔️ VA 0% DP | 5.625% / 5.848% | -.000% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

💡 Why This Matters

All eyes are on the Fed this Wednesday, as markets widely expect a rate cut. The 10-year Treasury has been trading in a tight range just above 4%, signaling investors are already pricing in the move.

A rate cut doesn’t automatically mean lower mortgage rates — in fact, the reaction depends on what the Fed says about future policy. If they hint this is just the first of several cuts, we could see a drop in yields. But if they take a “wait-and-see” tone, mortgage rates may stay near current levels.

🧭 Realtor Insight: Buyers may hear “rate cut” and expect big savings overnight. Remind them mortgage rates move on market expectations — not the Fed’s direct action — and patience could pay off in the coming weeks.

TECHNICALS

Inflation Cools Just in Time for the Fed

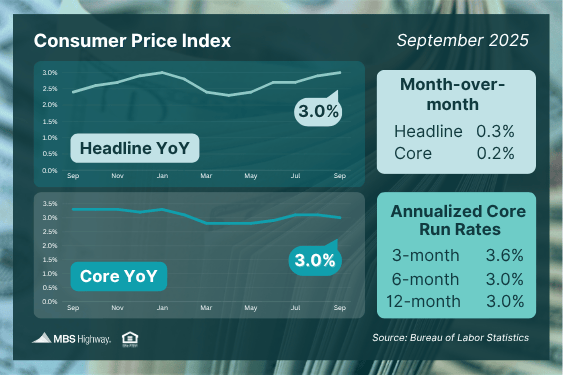

The latest Consumer Price Index came in softer than expected — a welcome sign for anyone watching rates. Inflation rose just 0.3% in September, with annual inflation slipping to 3%, giving the Fed a little more room to breathe ahead of tomorrow’s policy decision.

Markets are now fully pricing in another quarter-point rate cut, following the one in September. The focus won’t just be if they cut — it’ll be what they say next. A hint of more easing ahead could send mortgage rates lower again, while a cautious tone might keep them steady.

🔍 Realtor Insight:

Tomorrow’s Fed statement could set the tone for the rest of the year. A dovish message = more rate relief, potentially reigniting buyer urgency before the holidays.

Reply