- GTG Weekly

- Posts

- 💸 Fed on Hold, Pressure Builds Elsewhere

💸 Fed on Hold, Pressure Builds Elsewhere

Mortgage Rates Move UP ⬆️. Silver and Gold Temp CRASH. Newt Commute. New Fed Chair.

Issue 144 - Hello and Happy Tuesday.

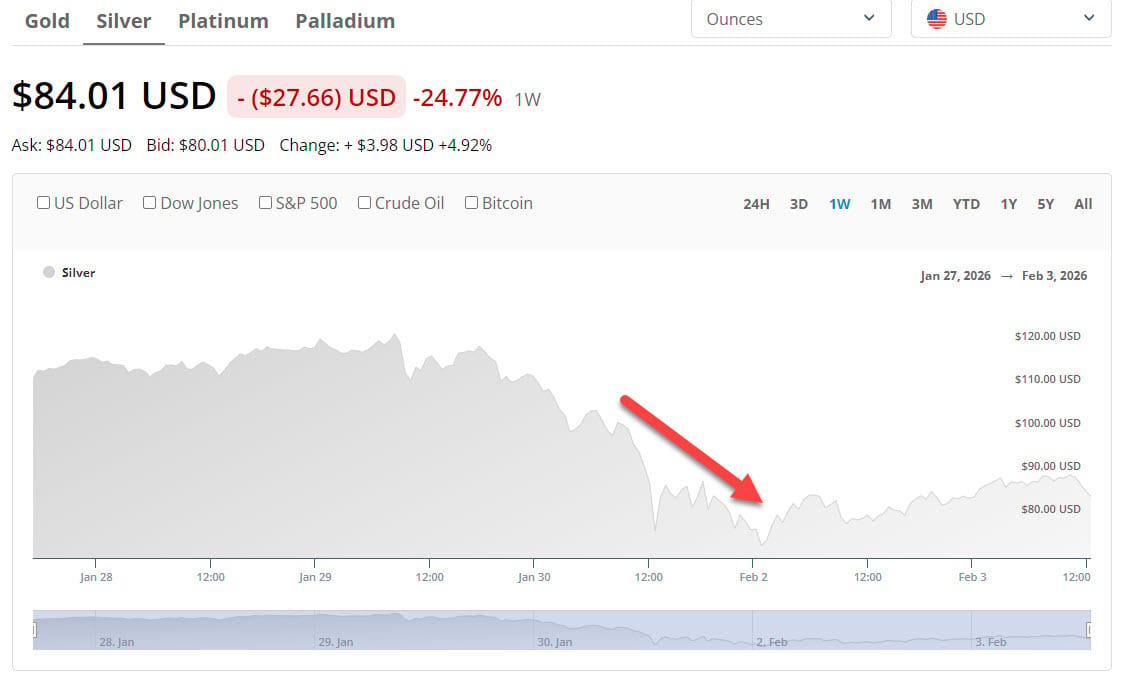

The Fed held rates last week, Trump nominated a new Fed Chair (as expected), and some of that led to a massive sell-off in Silver and Gold. Both had been on a burner for the last 6 months.

|  |

The estimates are that 7 TRILLION (with a T) was lost in 1 day last week, lol. Both have since started to recover, but Holy smokes.

Personal Note:

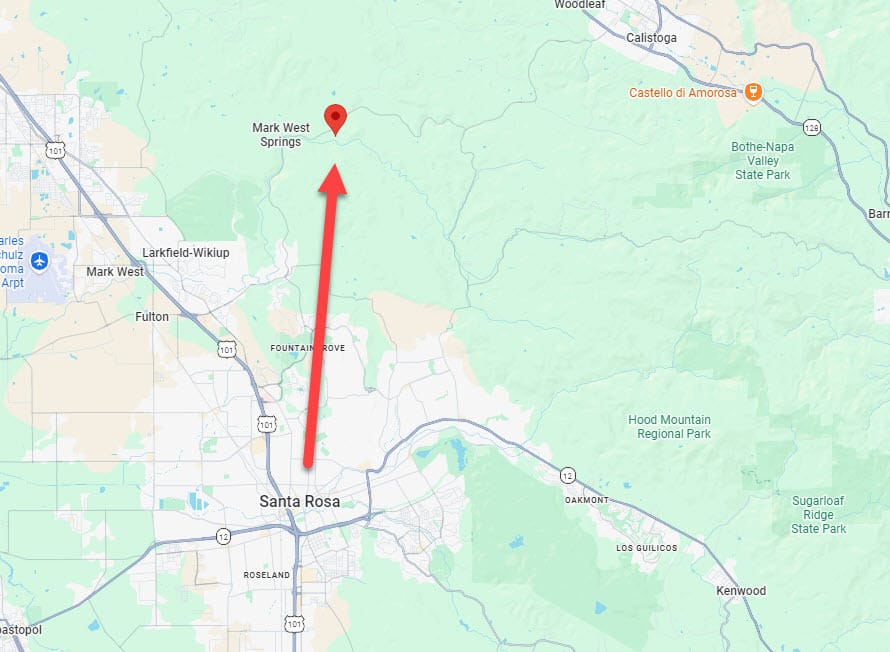

Jamie booked a fun outing called the “Newt Commute” through Sonoma County Regional Parks. We got to preview a future park under development and see one of its major attractions. California Newts!

Was only about a 20 min drive from home.

They found a tiny Newt! |  Red Belly adult Newt. |

TLDR (Too Long Didn’t Read) Summary

⬆️ RATES - Slight Bump UP

📊 TECHNICALS - Fed holds steady. New Fed Chair Named.

INTEREST RATES

Rates 📢 February 3rd, 2026

10 Year T-Note 180-day snapshot

Product | Rate / APR | Weekly Change |

|---|---|---|

↔️ Conv. | 5.990% / 6.031% | -.000% |

⬆️ Conv. HB | 6.375% / 6.433% | +.250% |

⬇️ JUMBO | 6.000% / 6.051% | -.125% |

⬆️ FHA 3.5% DP | 5.500% / 6.472% | +.250% |

⬆️ VA 0% DP | 5.500% / 5.748% | +.250% |

Rate data as of morning of publication. Unless noted otherwise, all scenarios are assuming 30 Year-Fixed mortgage, Purchase or R/T Refinance. No origination points charged, 780 FICO score, and 20% down payment. Provided for consumer education only and does not serve as a binding offer to extend lending. Payment period, interest rate, APR, and other terms subject to income, asset, and credit profile qualification. Provided courtesy of GTG Financial, Inc. NMLS 1595076. Equal housing opportunity. www.nmlsconsumeraccess.org

⏱️ Rates in 60 Seconds

Rates moved higher last week as markets headed into a heavy jobs week.

What’s driving it

Mortgage bonds sold off as investors positioned ahead of key labor data

Jobless claims continue to understate weakness by excluding gig workers, self-employed borrowers, and long-term unemployed whose benefits have expired

🏛 Fed backdrop

Fed Governor Waller says policy remains restrictive

Inflation excluding tariffs is near the Fed’s 2% target

Rate cuts remain possible, but markets want confirmation from jobs data

📆 This week

Friday’s Jobs Report is the primary driver for near-term rate direction

🧠 Realtor insight

Weaker jobs data supports lower rates

Strong data keeps upward pressure on rates

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, I break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

TECHNICALS

Fed Holds Rates Steady, Trump Names Chair Pick 🏦

The Fed hit pause at its first meeting of the year, President Donald Trump named his preferred next Fed Chair, and home price data showed buyers are still showing up despite affordability pressure.

Trump Taps Kevin Warsh for Fed Chair 👀

President Trump announced plans to nominate Kevin Warsh as the next Chair of the Federal Reserve, set to replace Jerome Powell when his term ends in May.

Why this matters:

🧭 Warsh previously served on the Fed’s Board from 2006–2011

🔥 Historically viewed as an inflation hawk

🔄 More recently, he has argued the Fed should move faster on rate cuts

⚖️ Signals a potential philosophical shift in future Fed leadership

Realtor Insight:

Markets care less about politics and more about policy direction. A Chair perceived as more rate-cut friendly can influence long-term rate expectations well before any actual changes occur.

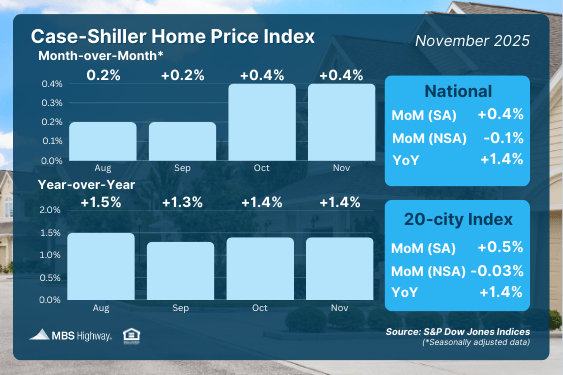

Buyer Demand Is Still Supporting Home Prices 🏠

Despite affordability challenges, national home prices remain firm.

Latest data:

S&P CoreLogic Case-Shiller Index

📉 –0.1% month over month (unadjusted)

📈 +0.4% after seasonal adjustment

📊 +1.4% year over year

FHFA Home Price Index

📈 +0.6% month over month

📈 +1.9% year over year

What’s driving this:

👥 Buyer demand improved as rates eased

🧱 Builders remain supply-constrained

⏳ New inventory cannot ramp quickly

Realtor Insight:

If rates drift even modestly lower, demand could re-accelerate faster than supply, putting renewed pressure on prices in competitive markets.

Labor and Inflation Check 📊

Labor market:

🧾 Initial jobless claims: 209,000

🔄 Continuing claims: 1.827 million

🛠️ Elevated continuing claims suggest longer job searches and gig-work substitution

Inflation:

📦 Producer Prices (PPI):

+0.5% month over month

+3.0% year over year

⚙️ Core PPI driven mainly by machinery and equipment margins

Realtor Insight:

Hot producer inflation keeps pressure on rates, even if consumer inflation cools. The Fed cannot ignore this data.

What to Watch This Week 👀

📌 Job Openings (Tuesday)

📌 ADP Private Payrolls (Wednesday)

📌 Weekly Jobless Claims (Thursday)

📌 Jobs Report and Unemployment Rate (Friday)

⚠️ Government funding negotiations could delay releases.

Reply